ISLAMABAD , NOV 08 : Udhaar Book, a digital bookkeeping app for small businesses in Pakistan, has raised $6 million in seed funding, it emerged on Monday.

The round saw the participation of multiple investors including Fatima Gobi Ventures (FGV), Plaid co-founder William Hockey’s Muir Capital, Tinder co-founder Justin Mateen’s JAM Fund, Commerce Ventures, Liberty City Ventures, Atlas Ventures, Integra Partners, Omri Dahan of Marqeta and Immad Akhund of Mercury Bank.

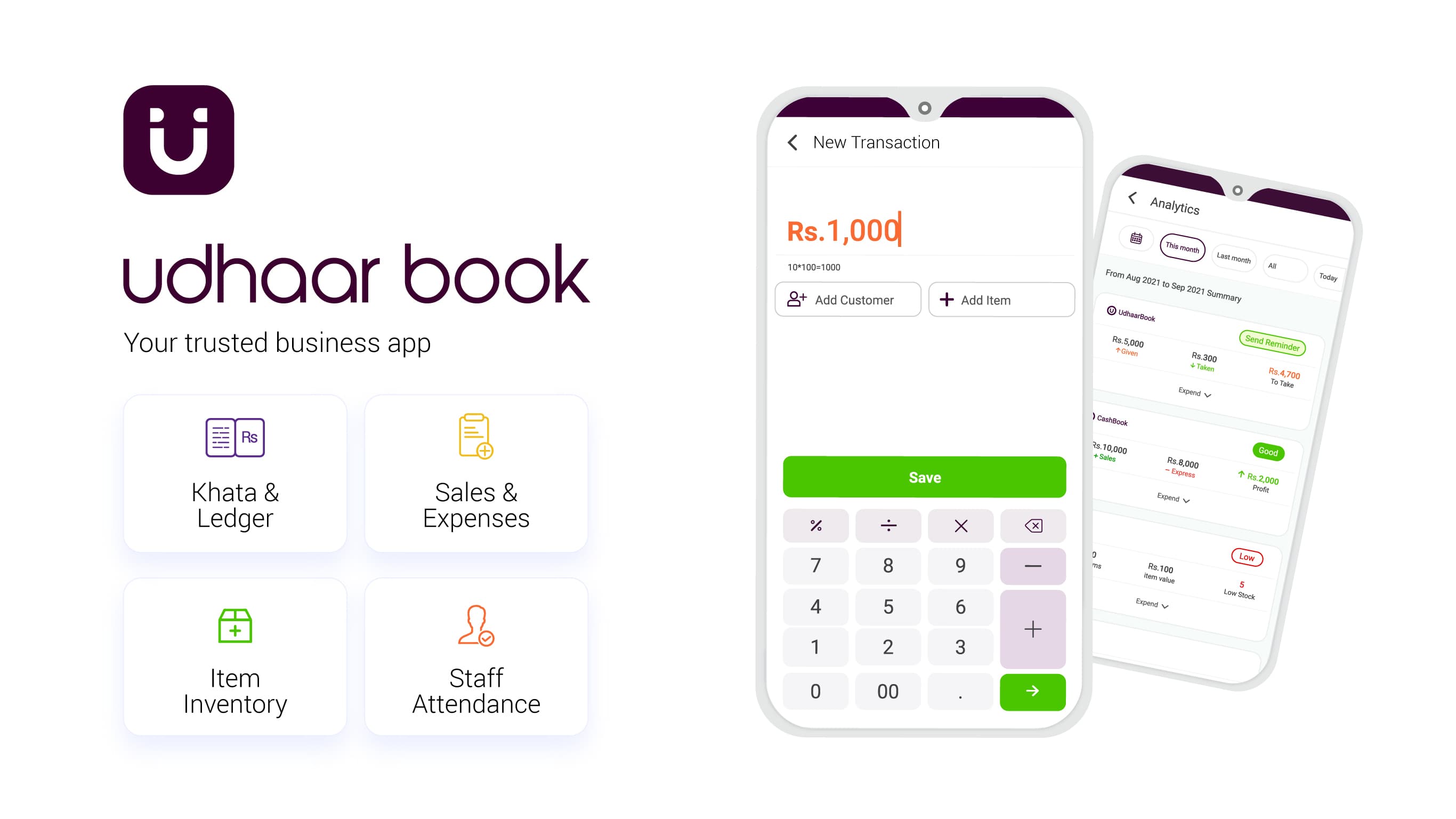

According to a press release, the funds will be used to build the app’s ecosystem, which now enables small businesses to conduct digital bookkeeping, manage inventory, invoicing, staff attendance and payroll.

Udhaar Book was launched last year to help small businesses keep a track of sales, expenses and credit and crossed over a million installs a few months ago.

The brainchild of Fahad Kamr, Shah Warraich, and Myra Ali, the app has since graduated from Y Combinator’s accelerator programme and expanded its solutions to become a super app for small businesses.

Kamr, Udhaar Book’s founder and CEO, said that a majority of small business owners in Pakistan continue to do their accounts on paper and process payments in cash which is kept in a “wooden cash drawer”.

“So small business owners typically work 16-hour days to monitor this drawer and minimise theft. Solving this problem requires digitising all manual elements of the business, while making the transition as seamless as possible for the already busy business owner,” he said.

“Udhaar Book has now evolved into a super app, essentially an operating system for small businesses. We free up the small merchant’s time so he can spend it with his family and develop the full potential of his business,” he added.

According to the press release, the startup has collaborated with various telecommunications firms and banks including Telenor, Zong, United Bank Limited, and Bank Alfalah in an effort to expand the app ecosystem.

“Our partnerships with telcos, banks, and wallets means Udhaar Book’s 1.4 million small merchants are now able to sell mobile top-ups digitally to earn ancillary income,” Kamr said.

He said that in the past three months, monthly active users have skyrocketed 300 per cent with over 1.4 million registered users across Pakistan and 510,000 monthly active users.

“Growth has been great, while retention rates are trending upwards as more business owners stay for our wide variety of solutions,” he said.

FGV General Partner Ali Mukhtar lauded Kamr and his team for taking the app to “new heights”.

“We can’t wait to see what is next in the pipeline, and are excited to join Udhaar Book on its journey to bring Pakistan into the global digital economy,” he said.

Tinder co-founder Justin Mateen noted that the app’s monthly active users had grown by over 1,100 per cent this year, a feat that was achieved by “focusing on the needs of their micro SME [small and medium enterprises] users”.

“Excited to be a part of the journey,” he said.

According to the press release, Pakistan is home to an estimated 25-30 million micro-SMEs that are still run manually.

“These small businesses contribute 74pc to the country’s gross domestic product, highlighting the massive value-add potential when their operations are digitised,” the statement said.