By: Eman Zahid Jokhio

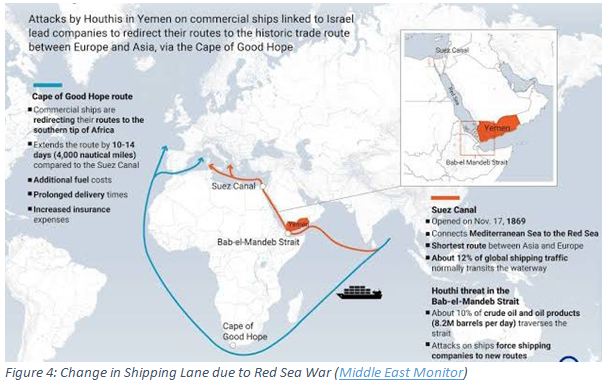

The necessity of maritime shipping for international trade is severely strained by several problems at major global maritime hubs. The main source of instability is the Houthi attacks on ships in the Red Sea and the Gulf of Aden, which are crucial arteries for ships passing via the Suez Canal. The US and UK forces respond to these attacks, which involve advanced weapons supported by Iran, raising fears of a larger conflict escalation. It now seems more difficult to access this important shipping channel, raising concerns about the long-term viability of the region’s maritime economy. The Houthis seek to strengthen their support base in Yemen while pressuring Western countries to demand a ceasefire in Gaza through their Red Sea attacks, which they defend as acts of sympathy with Palestinians. The Houthis struggle to provide for basic requirements in the face of Yemen’s protracted conflict and dire humanitarian problems. They deflect attention by portraying themselves as frontline defenders of the Palestinian cause against Israel and the United States of America. Moreover, the Houthis aim to gain international recognition by utilizing these attacks to demonstrate their significance in the global arena and avert being disregarded by more powerful nations.

Significance of Red Sea

• It connects the Indian Ocean to the Mediterranean Sea, as a mean of major trading route.

• It separates Northeastern Africa from the Arabian Peninsula.

• The Red Sea is the route for over 15% of all seaborne commerce worldwide, which includes 8% of all grain trade, 12% of all oil transport, and 8% of all liquefied natural gas trade.

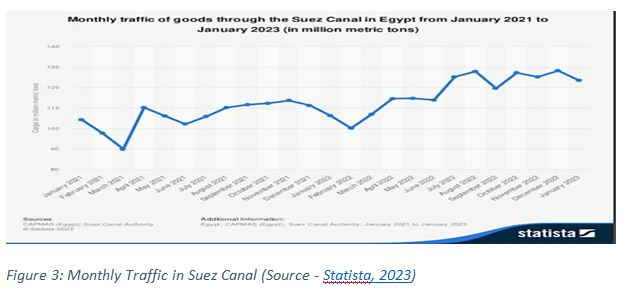

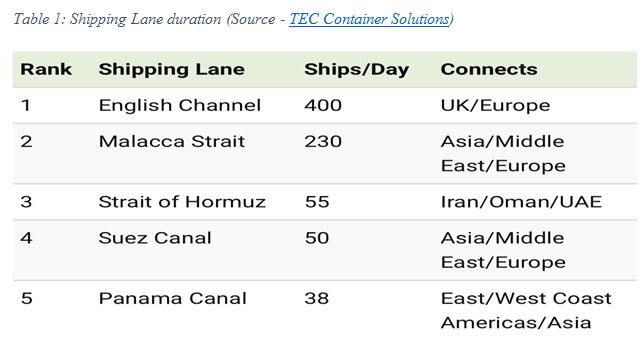

• The Suez Canal is one of the busiest shippinglanes in the world.

Global Economic Consequences of Attacks by Houthis

Trade routes must run smoothly and efficiently to support the world economy, and any hiccups or obstructions can have far-reaching effects. As a result, the stability and expansion of the world economy are negatively impacted by the ongoing Red Sea conflict. Therefore, several effects can be witnessed on the global economy due to this Red Sea crisis.

a) Uncertainty added to Global Supply Chain

The Red Sea issue is still developing, but it is already having a more significant effect on global supply networks than it did when the COVID-19 epidemic first broke out. Service networks are severely being disrupted by the Red Sea strikes. Throughout 2024, trade interruptions are probably going to persist, which will lead to more supply chain difficulties and increased inflationary pressures.

b) Global Trade is Declining

The attacks on cargo ships in the Red Sea were a major factor in the 1.3% decline in worldwide trade that occurred between November and December, reported by the Kiel Institute for the World Economy.

c) Increased Insurance Cost

The very first reason is that the insurance cost of transportation has increased. This simply means when this transpiration cost increases, the production cost will also increase – inculcating into inflation. Insurance costs for trips to the Bab al-Mandab and the Red Sea have increased significantly, according to analysts monitoring cargo insurance. These charges are currently up to 2 percent, while normally they are about 0.6 percent of the value of the cargo on a ship, according to Ali Ahmadi, an executive fellow at the Geneva Centre for Security Policy. The cost of traveling across the Suez Canal is further increased by cargo insurers who tack on an extra war risk premium.

d) Redirecting the Route

The second reason is that companies are suspending their operations from the Red Sea and redirecting their route – which is a long one. Ships operating in the southern hemisphere are starting to circumnavigate the Cape of Good Hope, but doing so incurs additional expenses and a two-week delay. According to Forgione, the cost of transporting containers from Asia to Europe has already gone up by 175–250% due to redirecting routes. She also points out that the price of petrol and oil has been extremely volatile.

e) Decline in Production

The economic rule is that when supply decreases, the price level tends to increase. The same can be witnessed in this scenario as several firms have stopped their operation due to a hurl in the supply chain. Due to supply delays, electric vehicle manufacturer Tesla is forced to close its manufacturing near Berlin starting Monday through February 11. A week-long production stoppage occurred at a Suzuki Motor Corp. plant in Hungary as a result of a delay in receiving engines and other parts from Japan. As reported by Bloomberg, Volvo has decided to temporarily suspend operations at its plant in Belgium, citing the need to divert ships transporting gearboxes to prevent acts of violence.

f) Delay in Goods Reaching to Customers

This longer route raises fuel expenses, lowers shipping efficiency, and may result in higher import prices, including vital shipments of Middle Eastern and Asian oil and grain.

g) Rise in OilPrices

Fears over the potential economic effects of disruptions of global trade through the Red Sea and rising tensions in the Middle East have caused oil prices to reach $80 (£62.83). The prices are expected to rise as this chaos is happening in the Middle East, and well everyone knows that ME is the hub of energy.

Conclusion

To sum up, the red sea crisis is haunting the memory of Russo-Ukrainian war once again. The attacks from both side is increasing the inflation level around the world, the trade level is hurled between states, the oil prices are at uncertain situation, and the supply chain are disrupted severely. This all economic chaos due to war in Red Sea ought to affect the lives of people around the world. These repercussions touch on different industries and nations, underscoring the global economy’s interdependence and susceptibility to hostilities in strategic areas. Thus, the economy which started to recover after Covid pandemic started to recover faced a stumbling block first from Russo-Ukrainian war and then now from Red Sea war – simply in a dwindling state.