According to Baradar, when the Islamic Emirate came to power in Afghanistan, the economic situation faced a serious threat, but now it is improving.

Kabul, SEPT 6: A conference was held with the participation of local businesspeople, foreign traders, members of the Afghan American Chamber of Commerce, and senior Islamic Emirate’s officials, at Serena hotel in Kabul to discuss Afghanistan’s economic and trade issues in 2023.

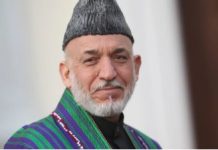

Speaking at the gathering, Mullah Abdul Ghani Baradar, the deputy PM for economic affairs, said that the Islamic Emirate will provide a variety of facilities for domestic and foreign traders in a bid to improve economic and commercial development.

According to Baradar, when the Islamic Emirate came to power in Afghanistan, the economic situation faced a serious threat, but now it is improving.

With the past two years, he said, administrative corruption has been eliminated, the cultivation and production of narcotics has been prevented, the Afghan currency has remained stable against foreign currencies, the price of food and non-food items has decreased, and there have been improvements in the banking sector. Also, the amount of exports and imports have increased as has national income and domestic food production.

Speaking at the same conference, AACC President Jeff Greico said that they have been working since August 2021 in in Washington, with the ABA (Afghanistan Banks Association) and all of the Afghan banks to help facilitate the return of the frozen assets of Afghanistan.

He said the frozen foreign assets of Afghanistan were divided into two parts; the beneficiary account deposit, and the foreign exchange reserves of Afghanistan from the previous government—which are located in the central bank of the United States and European countries.

According to Greico, the funds of the foreign exchange reserves “are not going to be returned to Afghanistan for the time being for a number of different reasons.”

However, he urged the Afghanistan Banking Association to work together on how to approach the return of the commercial bank assets “because there has been a change in the government’s thinking in the last few months and they are now willing to consider the return of those assets but due to the sanction regimes of both the United States and the UN, we are not allowed to return those through the Central Bank of Afghanistan, so we need to find a private sector way for the banks — and I would even say the US corresponding banks — to return that money.”