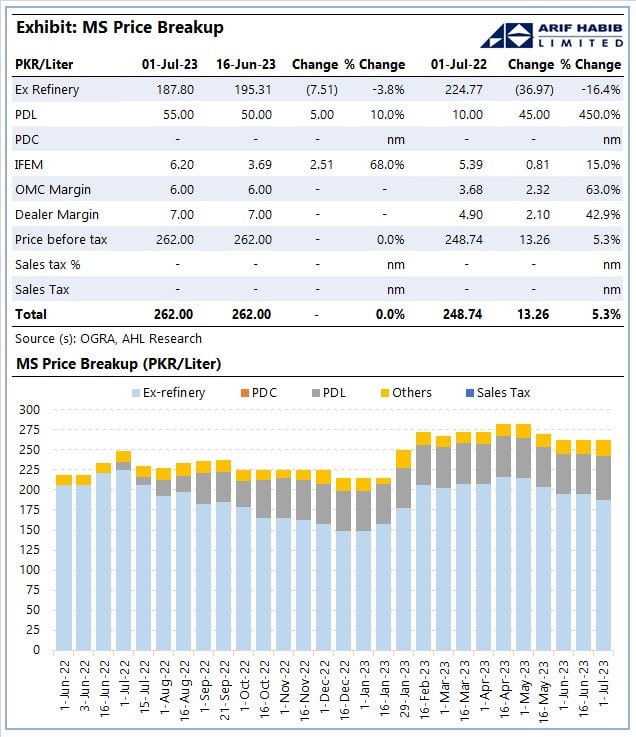

ISLAMABAD, JUL 1: The government Saturday decided to jack up the petroleum development levy (PDL) on petrol from Rs50 to Rs55 per litre following a $3 billion staff-level agreement signed with the International Monetary Fund (IMF) a day earlier.

The PDL on petrol has been imposed from the start of the new fiscal year, ie July 1 (today).

Moreover, the ministry said there would be no increase in the development levy on high-speed diesel (HSD), which is Rs50 per litre.

A day earlier, Finance Minister Ishaq Dar announced that diesel prices had been increased by Rs7.50 for the next fortnight; however, he said petrol prices would remain the same.

“There has been no increase in the price of petrol,” said Dar in a late-night press conference.

The finance czar also shared that the new diesel price will be effective from July 1.

According to The News, the government had sought powers for amendment of the Petroleum Products (Petroleum Levy) Ordinance, 1961 (XXV of 1961) in the Fifth Schedule, in column (1) through the Finance Act 2023-24, which empowers it to hike the petroleum levy.

Earlier, it required approval of parliament to fix the maximum limit of petroleum levy.

The Ministry of Finance informed the Senate Standing Committee on Finance that the PDL was worked out at Rs60 per litre for achieving its target of Rs879 billion in the next fiscal year, against the revised target of Rs542 billion for the outgoing financial year 2022-23 ending on June 30.

Pakistan, IMF sign $3 billion pact

Pakistan and the IMF on Friday reached a long-awaited staff-level agreement (SLA) on $3 billion “stand-by arrangement” (SBA), the global lender announced.

“I am pleased to announce that the IMF team has reached a staff-level agreement with the Pakistani authorities on a nine-month Stand-by Arrangement (SBA) in the amount of SDR2,250 million (about $3 billion or 111 percent of Pakistan’s IMF quota),” Nathan Porter, the IMF’s Mission Chief to Pakistan, said in a statement.

“The new SBA builds on the authorities’ efforts under Pakistan’s 2019 EFF-supported programme which expires end-June. This agreement is subject to approval by the IMF’s Executive Board, which is expected to consider this request by mid-July,” the statement added.

The $3 billion funding, spread over nine months, is higher than expected for Pakistan. The country was awaiting the release of the remaining $2.5 billion from a $6.5 billion bailout package agreed in 2019, which expires on Friday (today).

The deal came after an eight-month delay and offered some respite to Pakistan, which is battling an acute balance of payments crisis and falling foreign exchange reserves.

In the statement issued today, the IMF said since the completion of the combined seventh and eighth reviews under the 2019 EFF in August 2022, Pakistan’s economy faced several external shocks, such as the catastrophic floods in 2022 that impacted the lives of millions of Pakistanis and an international commodity price spike in the wake of Russia’s war in Ukraine.

As a result of these shocks and some policy missteps — including shortages from constraints on the functioning of the forex market — economic growth has stalled.

“Inflation, including for essential items, is very high. Despite the authorities’ efforts to reduce imports and the trade deficit, reserves have declined to very low levels,” the IMF’s statement said.

Moreover, it said liquidity conditions in the power sector also remain acute, with the further buildup of circular debt and frequent loadshedding.

The global lender said the new SBA would support Pakistan’s immediate efforts to stabilise the economy from recent external shocks, preserve macroeconomic stability and provide a framework for financing from multilateral and bilateral partners.

“The new SBA will also create space for social and development spending through improved domestic revenue mobilisation and careful spending execution to help address the needs of the Pakistani people.”

The IMF further added that steadfast policy implementation is key for Pakistan to overcome its current challenges, including through greater fiscal discipline, a market-determined exchange rate to absorb external pressures, and further progress on reforms, particularly in the energy sector, to promote climate resilience, and to help improve the business climate.